About the plan…

Public employees in Maine have long relied on the Maine Public Employees Retirement System (MainePERS) for meeting their retirement income needs. While the MainePERS defined benefit pension plans are the foundation for financial security in retirement, most public employees will need to supplement their pension benefits with retirement savings—a goal best achieved through a systematic, tax-advantaged plan like MaineSTART. MaineSTART offers Traditional (pre-tax) and Roth (after-tax) accounts.

MaineSTART consists of two types of retirement savings plans:

457 Deferred Compensation Plan

401(a)Defined Contribution Plan

Although there are differences, both plans work similarly to provide you with a tax-advantaged retirement savings program. Both plans offer the same investment options.

The MaineSTART Difference

Once you recognize the need and value of saving for retirement in a systematic, tax-advantaged plan, you can be overwhelmed with decisions that make it hard to follow through. That’s where MaineSTART comes in.

At MainePERS, we’ve done the hard work to make saving simple and effective. After thorough research, we have assembled a program to meet your needs.

Low Cost

High fees charged by mutual fund managers can impose a heavy drag on investment results. Many funds offered in the market today impose fees well in excess of 1% of your investment. Investment management fees, transaction fees, administration fees, marketing fees, and other, sometimes hidden, fees can drive up costs, and since the average mutual fund will provide a return just equal to the overall market over time, each of these fees and transaction costs will reduce your return to below the average. Clearly, minimizing cost is an important part of achieving satisfactory investment results.

MainePERS has chosen to offer index funds from a highly regarded nonprofit fund management company in order to minimize costs to you. These funds are among the lowest cost in the industry. They do not have marketing or distribution fees associated with them, and they do not share revenue with DC plan administrators. There are no upfront sales charges or back end redemption fees (with the exception of an early redemption fee for the international fund), both of which are typical in the universe of mutual funds, and which can cost as much as 5% or more of your assets and are not included in the stated expense ratio or management fee. There are no hidden fees. In addition, transaction costs are minimized in index funds, further limiting costs to you.

Convenience

MaineSTART makes it easy to enroll, make, or change your investment choices, and view your progress. Call 888-652-8086. or log on to Ascensus any time, 24/7. Because MaineSTART works through payroll deduction, you can make systematic savings a simple and powerful tool in your long-term financial plan.

Your Asset Allocation

Asset allocation refers to the proportions of your savings that are invested in different types of investments: for example, U.S. stocks, foreign stocks, Treasury bonds, real estate, etc. Studies have shown that your asset allocation will play a far greater role in your success than the specific funds you choose.

Investments in Bonds and Money-market Funds

For most savers, the greatest opportunity for long-term returns comes from investing in stocks, and the greatest stability comes from investments in bonds and money-market funds. Finding the right mix depends on when you need the funds to be available your time horizon and your ability to tolerate risk. Maintaining the right mix involves revisiting those factors every so often, and rebalancing your investments (because different investments grow at different rates) to return to the right allocation.

Professional Investment Managers

For savers who want the benefit of professional investment managers making these asset allocation decisions for them, MaineSTART offers a selection of so-called lifecycle or Target Retirement Date mutual funds. These funds relieve you of the burden of asset allocation, rebalancing, and fund selection by basing your investment on a retirement date of your choice. After you select the fund that most closely matches your planned retirement, a professional money manager then chooses an asset allocation in the early years that assumes greater risk, changing the allocation over time to reduce risk as your target retirement date nears. For the vast majority of our participants, we think this is the most appropriate investment vehicle for their retirement savings.

Balanced Option Fund

For participants who want the benefit of professional management, but want to have a constant asset allocation, MaineSTART offers a balanced option fund. A balanced fund is a stable mix of stocks and bonds, and may be appropriate for those with slightly higher risk tolerances. Keep in mind that the risk level of this fund is not designed to decline as you near retirement.

Broad Market Index Funds

Finally, for savers who want to customize and control their asset allocation, MaineSTART offers an array of broad market index funds. These funds help you with the allocation process by greatly simplifying it. The key decision is how much you want to invest in each type of asset. By using broad market funds, the participant can be assured they are getting appropriate diversification within each asset type, an important quality for any portfolio. While participants are free to use these funds either by themselves or in conjunction with the other options, this option is most appropriate for those well versed in finance and portfolio construction.

The Tax-Advantaged Benefits

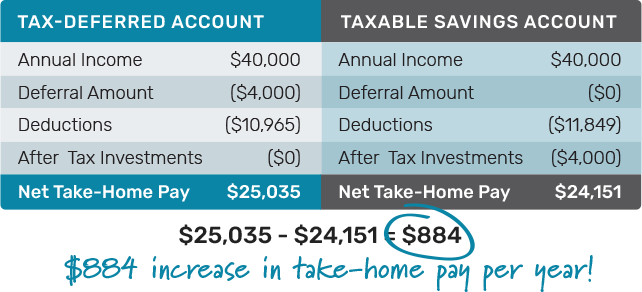

With MaineSTART, more of your money is working for you instead of going toward taxes. The following shows the benefits of tax-advantaged savings and how catching up can be costly.